October 28: ONLINE ONLY Discovery Art Auction

online only auction | 9 day sale | 8 days remaining

Location

Chadds Ford, PA 19317 Dates

Sale Starts

Mon

Oct 20

10amSale Ends

Tue

Oct 28

10amTerms & Conditions

Bidding

Online Auction with Pre Bidding available

Mobile bidding is available on our website or with the Bunch Auctions App available in iTunes for iPhone or iPad, and Google Play for Android devices.

Whether you bid from a mobile device or computer, all are synched together in real-time to the auction room. Never miss a bid!

Buyer’s Premium

Buyers bidding over the phone, or with our BunchLive bidding platform will pay the in-house premium of 25%.

Buyers paying with cash or check will pay a reduced premium of 22%

We accept USA based Visa, MasterCard, and Discover credit and debit cards. If the total amount owed is under $1,000 you can pay online at any time via our secure payment portal (1 time per 24hrs per card per IP address ONLY): https://safe-secure-payments.com/bunchauctions/paymentForm.php?PayMethod=CC If the total amount owed is over $1,000 and you have a previous buyer history with us, you can pay over the phone by calling 610-558-1800 during regular office hours (M-F 9:00am-5:00pm) Please reference the premium and sales tax attachments to ensure that you are submitting the correct amount. Any questions or concerns please do not hesitate to contact our office by phone at 610-558-1800. Thank you, Client Services William Bunch Auctions & Appraisals

Bid Increments

Visit our FAQ to view our bid increment table

Shipping Terms

William Bunch Auctions will be doing scheduled appointments for pick ups. Once your item(s) are paid in full we will contact you for a pick up date and time. If you are having your items shipped from our warehouse we must know who you will be using to ship your items. SALES TAX RULES AND POLICIES OF WILLIAM BUNCH AUCTIONS EFFECTIVE IMMEDIATELY, MAY 24, 2022 BECAUSE OF EVOLVING SALES TAX LAWS AND REGULATIONS, WE ARE REQUIRED TO COLLECT PA SALES TAX ON ALL PURCHASES THAT ARE PICKED UP AT OUR PLACE OF BUSINESS, REGARDLESS OF WHETHER THE PERSON OR ENTITY PICKING UP IS THE BUYER, A PRIVATE AGENT OF THE BUYER (FRIEND OR RELATIVE), OR A PACKER/SHIPPER HIRED BY THE BUYER IRRESPECTIVE OF THE FINAL DESTINATION OF THE PROPERTY. BUYERS FROM OUTSIDE THE US WILL BE SUBJECT TO THE SAME RULES. CURRENT PA SALES TAX IS 6% WHICH IS APPLIED TO THE HAMMER PRICE PLUS BUYERS PREMIUM. PLEASE NOTE THAT WE DO NOT DO ANY PACKING AND SHIPPING IN-HOUSE EXCEPTIONS: 1. THE BUYER HAS A VALID AND CURRENT PA SALES TAX LICENSE FOR THE RESALE OF THE PURCHASED ITEMS. YOU MUST SUPPLY US WITH A COPY OF THAT LICENSE AND FILL OUT THE PENNSYLVANIA EXEMPTION CERTIFICATE (REV-1220) 2. OUT OF STATE BUYERS HAVE A VALID SALES TAX LICENSE IN THEIR STATE OF RESIDENCE FOR THE RESALE OF THE PURCHASED ITEMS. AGAIN, YOU MUST SUPPLY US WITH A COPY OF THAT LICENSE AND FILL OUT THE PENNSYLVANIA EXEMPTION CERTIFICATE (REV-1220) 3. RESIDENTS OF STATES WITH NO SALES TAX WILL NEED TO SUPPLY US WITH A BUSINESS LICENSE FOR A BUSINESS ENGAGED IN THE RESALE OF THE PURCHASED ITEMS AND FILL OUT THE PENNSYLVANIA EXEMPTION CERTIFICATE (REV-1220) 4. THOSE SEEKING EXEMPTION FROM SALES TAX MUST PROVIDE A VALID PA REV-1220 AND LICENSE 3 DAYS PRIOR TO PURCHASES LEAVING THE PREMISES. WE VERIFY ALL SALES TAX LICENSES WITH THE STATE OF ISSUANCE. IF FOR ANY REASON WE CANNOT CONFIRM THE NUMBER AT TIME OF PICKUP, WE WILL CHARGE YOU 6% SALES TAX. IF SALES TAX LICENSE IS CONFIRMED AS VALID WITHIN 2 WEEKS FROM THE DATE OF PAYMENT, A REFUND WILL BE ISSUED. THERE WILL BE NO EXCEPTIONS TO THESE RULES!!!! Please contact the office for any additional information at 610-558-1800.

Online Auction with Pre Bidding available

Mobile bidding is available on our website or with the Bunch Auctions App available in iTunes for iPhone or iPad, and Google Play for Android devices.

Whether you bid from a mobile device or computer, all are synched together in real-time to the auction room. Never miss a bid!

Buyer’s Premium

Buyers bidding over the phone, or with our BunchLive bidding platform will pay the in-house premium of 25%.

Buyers paying with cash or check will pay a reduced premium of 22%

We accept USA based Visa, MasterCard, and Discover credit and debit cards. If the total amount owed is under $1,000 you can pay online at any time via our secure payment portal (1 time per 24hrs per card per IP address ONLY): https://safe-secure-payments.com/bunchauctions/paymentForm.php?PayMethod=CC If the total amount owed is over $1,000 and you have a previous buyer history with us, you can pay over the phone by calling 610-558-1800 during regular office hours (M-F 9:00am-5:00pm) Please reference the premium and sales tax attachments to ensure that you are submitting the correct amount. Any questions or concerns please do not hesitate to contact our office by phone at 610-558-1800. Thank you, Client Services William Bunch Auctions & Appraisals

Bid Increments

Visit our FAQ to view our bid increment table

Shipping Terms

William Bunch Auctions will be doing scheduled appointments for pick ups. Once your item(s) are paid in full we will contact you for a pick up date and time. If you are having your items shipped from our warehouse we must know who you will be using to ship your items. SALES TAX RULES AND POLICIES OF WILLIAM BUNCH AUCTIONS EFFECTIVE IMMEDIATELY, MAY 24, 2022 BECAUSE OF EVOLVING SALES TAX LAWS AND REGULATIONS, WE ARE REQUIRED TO COLLECT PA SALES TAX ON ALL PURCHASES THAT ARE PICKED UP AT OUR PLACE OF BUSINESS, REGARDLESS OF WHETHER THE PERSON OR ENTITY PICKING UP IS THE BUYER, A PRIVATE AGENT OF THE BUYER (FRIEND OR RELATIVE), OR A PACKER/SHIPPER HIRED BY THE BUYER IRRESPECTIVE OF THE FINAL DESTINATION OF THE PROPERTY. BUYERS FROM OUTSIDE THE US WILL BE SUBJECT TO THE SAME RULES. CURRENT PA SALES TAX IS 6% WHICH IS APPLIED TO THE HAMMER PRICE PLUS BUYERS PREMIUM. PLEASE NOTE THAT WE DO NOT DO ANY PACKING AND SHIPPING IN-HOUSE EXCEPTIONS: 1. THE BUYER HAS A VALID AND CURRENT PA SALES TAX LICENSE FOR THE RESALE OF THE PURCHASED ITEMS. YOU MUST SUPPLY US WITH A COPY OF THAT LICENSE AND FILL OUT THE PENNSYLVANIA EXEMPTION CERTIFICATE (REV-1220) 2. OUT OF STATE BUYERS HAVE A VALID SALES TAX LICENSE IN THEIR STATE OF RESIDENCE FOR THE RESALE OF THE PURCHASED ITEMS. AGAIN, YOU MUST SUPPLY US WITH A COPY OF THAT LICENSE AND FILL OUT THE PENNSYLVANIA EXEMPTION CERTIFICATE (REV-1220) 3. RESIDENTS OF STATES WITH NO SALES TAX WILL NEED TO SUPPLY US WITH A BUSINESS LICENSE FOR A BUSINESS ENGAGED IN THE RESALE OF THE PURCHASED ITEMS AND FILL OUT THE PENNSYLVANIA EXEMPTION CERTIFICATE (REV-1220) 4. THOSE SEEKING EXEMPTION FROM SALES TAX MUST PROVIDE A VALID PA REV-1220 AND LICENSE 3 DAYS PRIOR TO PURCHASES LEAVING THE PREMISES. WE VERIFY ALL SALES TAX LICENSES WITH THE STATE OF ISSUANCE. IF FOR ANY REASON WE CANNOT CONFIRM THE NUMBER AT TIME OF PICKUP, WE WILL CHARGE YOU 6% SALES TAX. IF SALES TAX LICENSE IS CONFIRMED AS VALID WITHIN 2 WEEKS FROM THE DATE OF PAYMENT, A REFUND WILL BE ISSUED. THERE WILL BE NO EXCEPTIONS TO THESE RULES!!!! Please contact the office for any additional information at 610-558-1800.

William Bunch Auctions & Appraisals, LLC

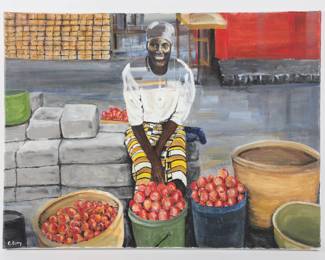

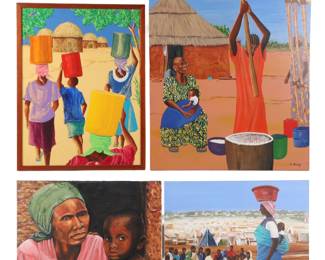

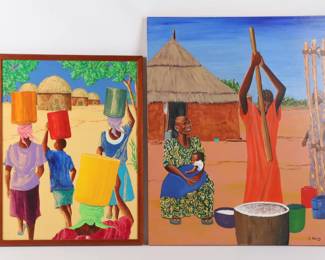

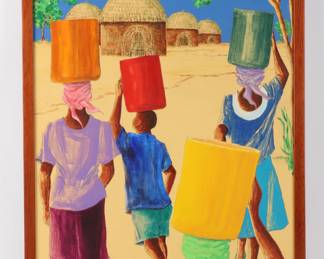

Description & Details

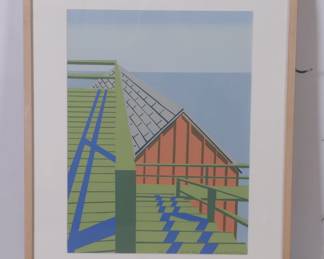

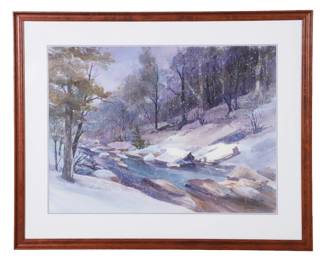

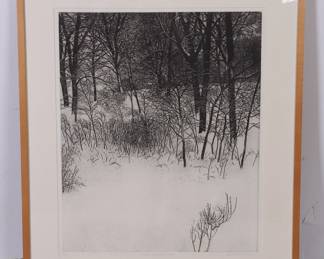

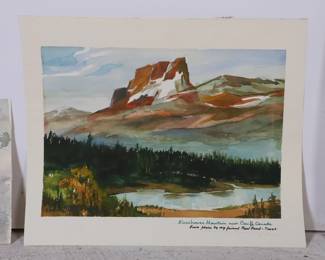

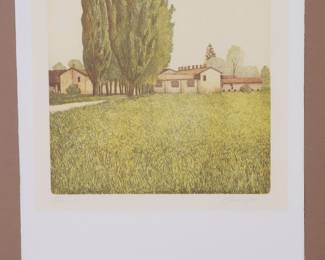

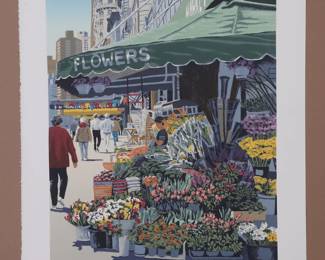

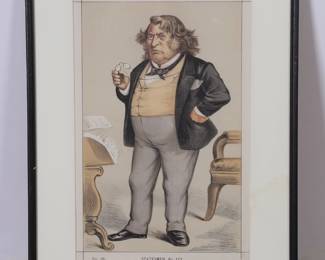

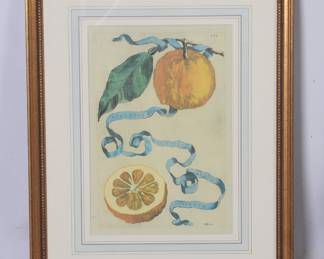

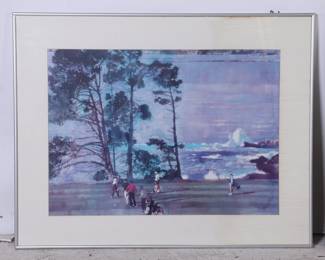

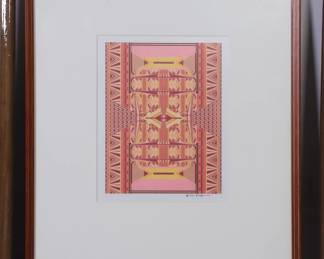

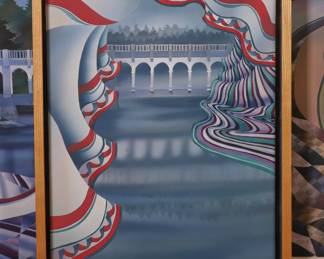

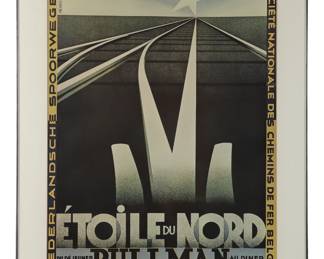

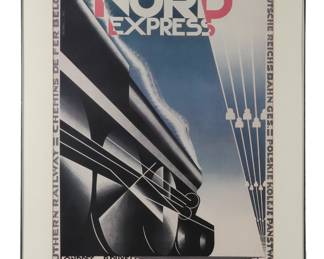

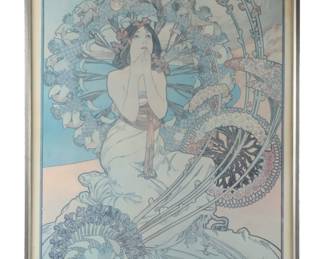

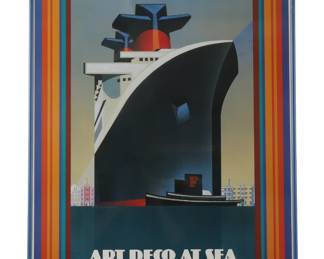

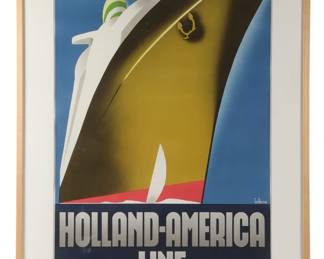

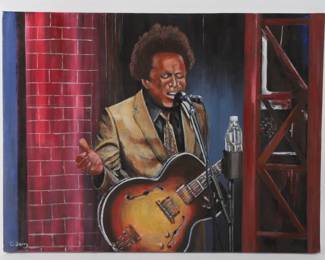

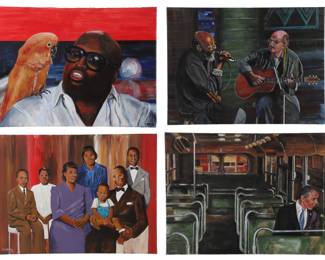

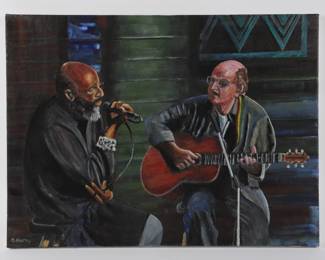

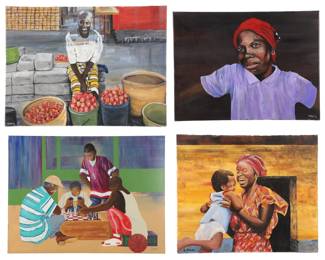

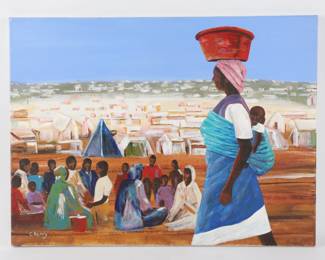

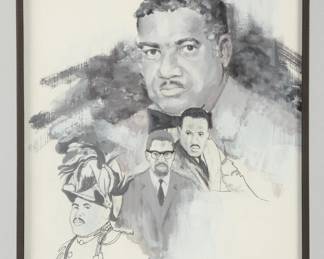

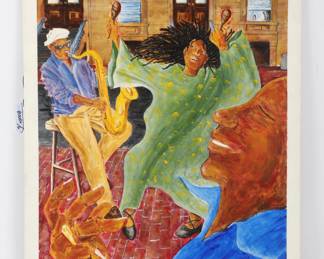

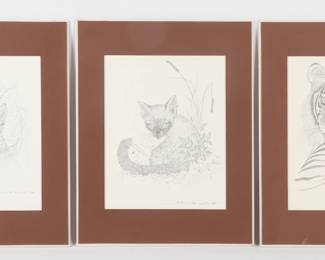

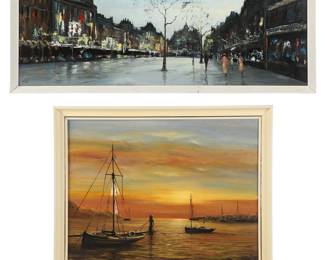

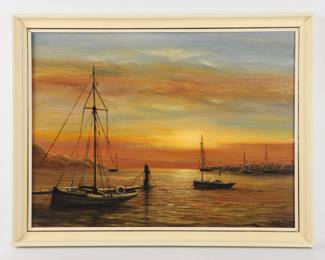

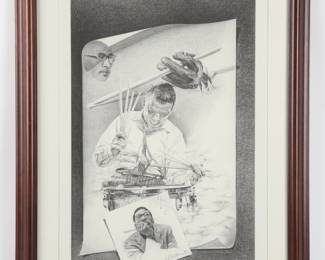

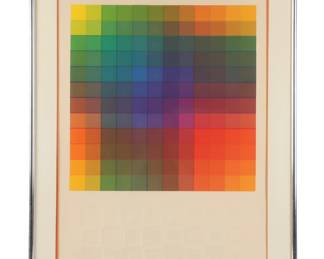

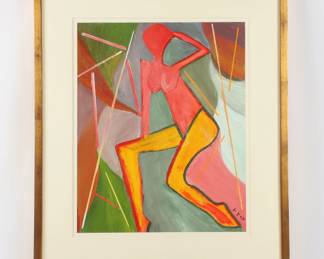

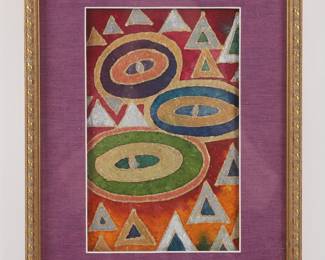

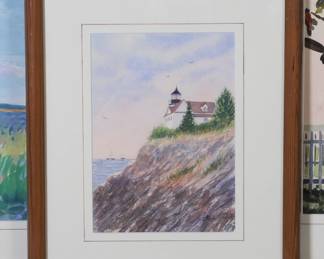

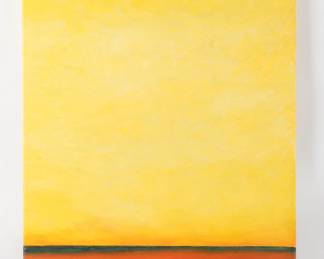

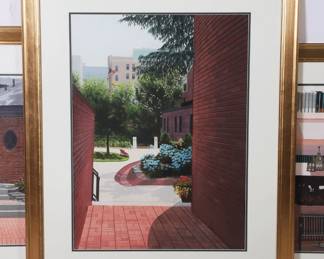

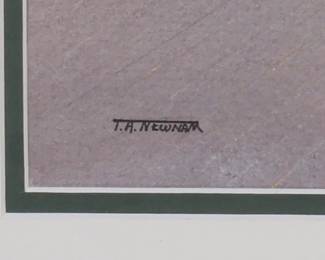

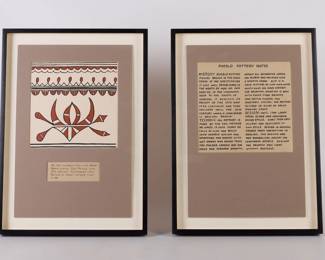

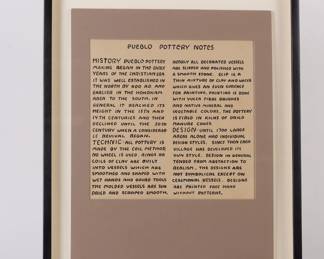

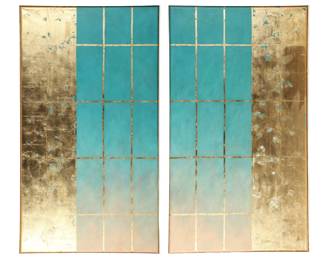

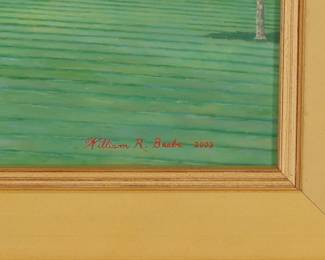

William Bunch Auctions proudly presents a great collection of fresh to market art.

Thank you for using EstateSales.NET. You're the best!